Most lenders will normally Assess the next to determine when you’re an excellent suit for a small business financial loan:

A lender typically determines your mortgage Restrict based on your creditworthiness and money. The most important restrictions are reserved for high-skilled borrowers.

Caret Down You could take a look at crowdfunding platforms, particularly if that you are launching a whole new item you can easily generate buzz about. Just remember that functioning a crowdfunding campaign requires a lots of legwork.

If reducing a charge card Invoice, rent, utility bill or property finance loan payment for a month or two would provide plenty of reduction, inquire a couple of payment system.

You may use a industrial real estate mortgage to invest in or lease a physical Place for your business. Some lenders provide as many as $five million in funding with prolonged repayment periods and competitive desire prices.

And when you will find several choices open up for you, then compare bank loan limitations and interest charges to discover the one that very best fulfills your needs.

Several credit score unions offer little personalized loans beginning about $500. To qualify you, They could look at information and facts in addition to your credit rating score, like your historical past to be a member.

Credit history unions work likewise to banking institutions, and infrequently present decreased premiums to individuals with reasonable credit. They also frequently have selections for borrowers who will need more compact bank loan quantities. But for a fast personal loan, you may need to now be described as a member in fantastic standing.

Bank loan repayments can develop an additional financial pressure to the small business, particularly if the organization will not qualify for lower premiums due to credit rating rating or income troubles

A FICO score/credit score score is used to symbolize the creditworthiness of someone and should be one particular indicator on the financial loans you will be qualified for. Having said that, credit history rating by itself won't warranty or suggest approval for any monetary item.

This is a type of protection for lenders requiring the borrower to repay the personal loan from their personalized assets In the event the organization defaults. A personal ensure click here can help some organizations accessibility credit that typically would not qualify.

Once you have your charges within the prequalification method, you are able to take a look at which lenders can present one of the most favorable rates to find the ideal compact company loans in your case.

Achievable reviews applicants’ bank account transactions to determine whether or not they qualify as well as their bank loan sum, even so the lender doesn’t do a tough credit history Look at. The lender stories payments to Experian and TransUnion.

In keeping with our evaluation of eighteen popular lenders, Up grade offers the ideal individual loans for negative credit. It requires a bare minimum credit rating rating of 580, giving People with bad credit history an opportunity to protected the funding they require.

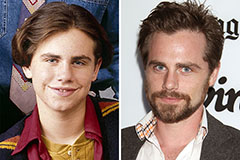

Rider Strong Then & Now!

Rider Strong Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Joseph Mazzello Then & Now!

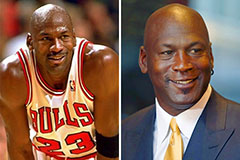

Joseph Mazzello Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!